They are among the most disappointing cases I have seen in over 30 years of practice as a Louisville Car Accident attorney. All of these were clear liability cases:

Example #1: Young man, 13 years old. Catastrophic injuries, over $1 million in medical bills. Total amount of liability and underinsured motorist coverage available for his injuries: $100,000.

Example #2: Young woman, 19 years old. Broken leg, internal injuries. Hospital bill alone was over $100,000. Total amount of coverage available for her injuries: $50,000 in liability insurance.

Example #3: 58 year old man, victim of hit-and-run, broken femur and forearm, over $100,000 in medical expenses. Total amount of uninsured motorist coverage available for his injuries: $25,000.

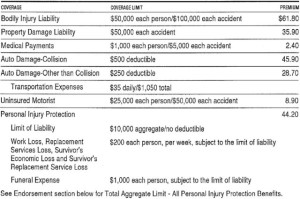

Many people think they have “full coverage.” Too often this means they only have minimum coverage.

The main reason you should buy auto insurance is to protect you and your family from serious accidents, not just the minor ones. Higher limits do not cost that much more than the minimum coverage.

Make sure you and your family are fully protected by purchasing all the auto insurance you can reasonably afford.

If you would like for us to review your auto coverage, please give us a call!